Comprehensive Guide To The Intricacies Of A 4 1 Stock Split

A 4 1 stock split is a financial strategy that companies employ to adjust their stock prices and increase their shares' liquidity. By dividing existing shares, a company can make its stock more appealing to a broader range of investors, potentially boosting the overall market value. This maneuver is often executed when a company's stock price has risen substantially, making it less accessible to smaller investors. Understanding the mechanics and implications of a 4 1 stock split can provide investors with valuable insights into a company's financial health and future growth prospects.

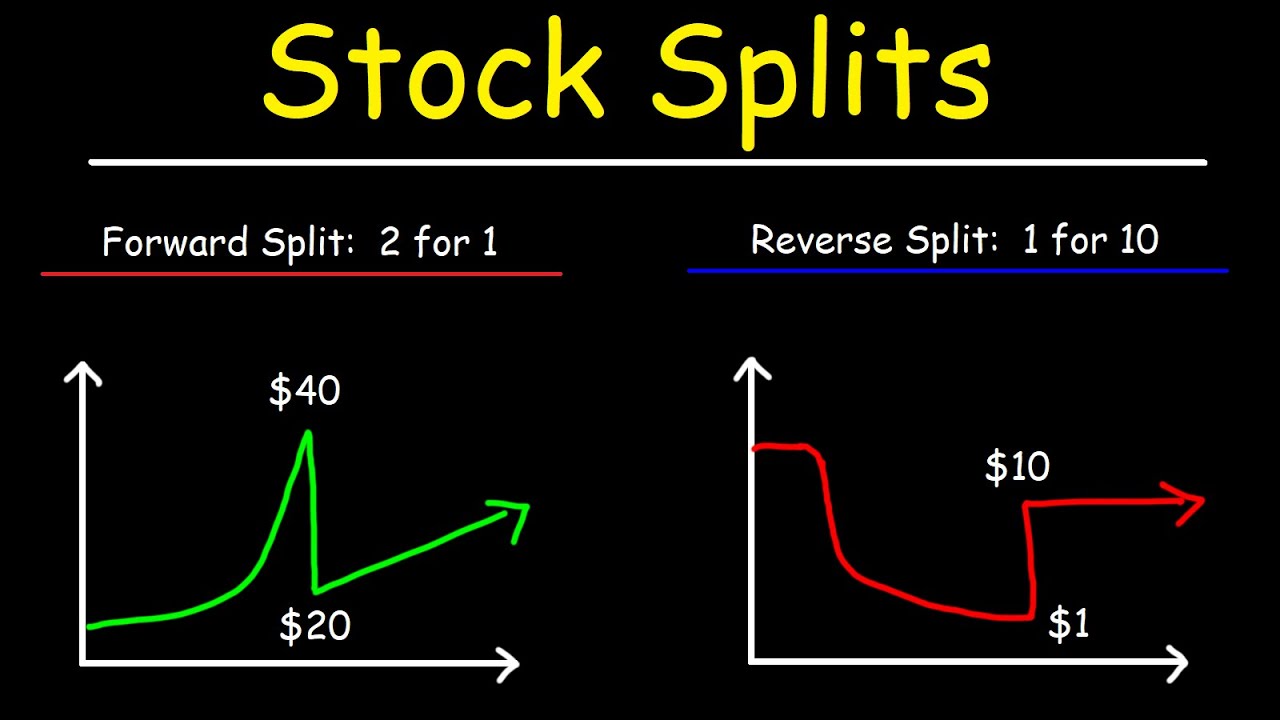

In the world of investing, stock splits are a common occurrence, representing a tactical move by companies to adjust their stock prices. A 4 1 stock split specifically means that for every one share an investor holds, they receive four additional shares. This results in an increase in the total number of outstanding shares while maintaining the same overall value of an investor's portfolio. Companies typically announce these splits to keep their stock prices within a desirable range, making them more attractive to potential investors and enhancing trading liquidity.

Investors often react favorably to stock splits as they can signal a company's robust financial health and confidence in future earnings. A 4 1 stock split can also serve as a psychological indicator, suggesting that the company's stock is performing well. However, it's crucial to remember that while the number of shares increases, the underlying value remains unchanged. The real impact on an investor's portfolio depends on how the market perceives and reacts to the split, making it essential to consider the broader market context and the company's strategic goals.

| Table of Contents |

|---|

| 1. Introduction to Stock Splits |

| 2. Understanding the 4 1 Stock Split |

| 3. Historical Context of Stock Splits |

| 4. Mechanism of a 4 1 Stock Split |

| 5. Benefits of a 4 1 Stock Split |

| 6. Potential Drawbacks of Stock Splits |

| 7. Case Studies of 4 1 Stock Splits |

| 8. Market Reactions to Stock Splits |

| 9. Impact on Company Valuation |

| 10. Investor Considerations |

| 11. Comparing Stock Splits and Stock Dividends |

| 12. Legal and Regulatory Aspects |

| 13. Frequently Asked Questions |

| 14. External Resources for Further Reading |

| 15. Conclusion |

1. Introduction to Stock Splits

Stock splits are a strategic financial maneuver used by publicly traded companies to adjust their share prices. By increasing the number of shares outstanding, the company effectively lowers the price of each share while keeping the overall market capitalization unchanged. This approach is often employed to make shares more affordable and accessible to a wider range of investors, thereby enhancing liquidity in trading. Stock splits can be seen as a sign of a company's growth and confidence in its future performance, as they typically occur after a period of significant stock price appreciation.

2. Understanding the 4 1 Stock Split

The 4 1 stock split is a specific type of stock split where shareholders receive four additional shares for every share they currently hold. This results in a fivefold increase in the total number of shares outstanding. However, the market value of each share is adjusted accordingly to ensure that the overall value of an investor's holdings remains the same. The primary aim of a 4 1 stock split is to make the stock more attractive to investors by lowering the price per share, thus broadening the potential investor base.

3. Historical Context of Stock Splits

Stock splits have been a tool used by companies for decades to manage stock prices and attract investors. Historically, stock splits have often been associated with periods of rapid growth and expansion, as companies seek to capitalize on their increasing market value. By examining past instances of stock splits, investors can gain insights into the factors that drive companies to make such decisions and how these actions have impacted their long-term growth trajectory.

4. Mechanism of a 4 1 Stock Split

The mechanism of a 4 1 stock split involves several key steps. First, the company announces the stock split, detailing the ratio and the effective date. On the designated date, the company issues additional shares to existing shareholders based on the split ratio. This results in an increase in the total number of shares outstanding, while the price per share is adjusted downward. The company's overall market capitalization remains unchanged, as the increased number of shares is offset by the lower price per share.

5. Benefits of a 4 1 Stock Split

There are several benefits to implementing a 4 1 stock split. Firstly, it can increase the stock's liquidity by making it more affordable for smaller investors, thus broadening the potential investor base. Secondly, it can enhance the company's visibility and marketability, as a lower stock price may attract more attention from analysts and media outlets. Additionally, a 4 1 stock split can signal the company's confidence in its future growth prospects, potentially boosting investor sentiment and driving demand for the stock.

6. Potential Drawbacks of Stock Splits

Despite the benefits, stock splits also come with potential drawbacks. One concern is that a stock split may create the perception of artificial growth, leading to inflated stock prices that do not accurately reflect the company's underlying value. Additionally, the administrative costs associated with executing a stock split can be significant, particularly for companies with a large number of shareholders. Furthermore, stock splits do not fundamentally change the company's financial position or performance, meaning that any increase in stock price following a split may be short-lived if not supported by strong financial results.

7. Case Studies of 4 1 Stock Splits

Several high-profile companies have executed 4 1 stock splits in recent years, providing valuable case studies for investors. For example, a well-known tech company may have chosen to split its stock to capitalize on its soaring market value and attract a larger investor base. By analyzing these case studies, investors can gain insights into the factors that drive companies to implement stock splits and the impact these actions have had on their stock performance and market perception.

8. Market Reactions to Stock Splits

Market reactions to stock splits can vary widely, depending on factors such as the company's financial performance, industry conditions, and investor sentiment. In some cases, stock splits are met with enthusiasm by investors, leading to an increase in stock price and trading volume. However, in other instances, stock splits may fail to generate significant market interest, particularly if investors perceive the move as a mere cosmetic change without any underlying improvements in the company's financial outlook.

9. Impact on Company Valuation

A 4 1 stock split does not inherently affect a company's valuation, as the overall market capitalization remains unchanged. However, the stock split can influence investor perception and demand, potentially impacting the company's valuation indirectly. For example, a well-received stock split may lead to increased investor interest and higher trading volumes, which can drive up the stock price and, consequently, the company's market value. Conversely, a poorly received stock split may result in a decline in investor confidence and stock price, negatively affecting the company's valuation.

10. Investor Considerations

Investors considering a 4 1 stock split should carefully evaluate the company's financial health, growth prospects, and industry conditions. While stock splits can signal positive developments, they do not guarantee future success or improved financial performance. Investors should also consider the potential tax implications of a stock split, as the increase in shares may affect their cost basis and capital gains calculations. Ultimately, a thorough analysis of the company's fundamentals and market environment is essential for making informed investment decisions related to stock splits.

11. Comparing Stock Splits and Stock Dividends

Stock splits and stock dividends are both methods companies use to return value to shareholders, but they differ in their mechanics and implications. In a stock split, the number of shares outstanding increases, and the price per share decreases, while the overall market capitalization remains unchanged. In contrast, a stock dividend involves issuing additional shares to shareholders, which can dilute the value of existing shares but provides shareholders with additional equity in the company. Understanding the differences between these two strategies can help investors assess their potential impact on their portfolios.

12. Legal and Regulatory Aspects

Stock splits are subject to various legal and regulatory requirements, which can vary depending on the jurisdiction and the company's regulatory environment. Companies must comply with securities laws and stock exchange rules when executing a stock split, including providing adequate notice to shareholders and ensuring accurate disclosure of the split's terms and impact. Failure to adhere to these requirements can result in legal and regulatory consequences, highlighting the importance of careful planning and execution in the stock split process.

13. Frequently Asked Questions

Q1: What is a 4 1 stock split?

A 4 1 stock split is a corporate action where a company issues four additional shares for every share held by shareholders, resulting in a fivefold increase in the total number of shares outstanding.

Q2: How does a 4 1 stock split affect my investment?

A 4 1 stock split increases the number of shares you own, but the overall value of your investment remains unchanged, as the price per share is adjusted downward to reflect the increased share count.

Q3: Why do companies implement stock splits?

Companies implement stock splits to make their shares more affordable and accessible to a broader range of investors, enhance liquidity, and signal confidence in their future growth prospects.

Q4: Are there any tax implications of a stock split?

Stock splits do not typically have immediate tax implications, as they do not result in a gain or loss for shareholders. However, they may affect the cost basis and capital gains calculations for tax purposes.

Q5: How do stock splits impact the stock market?

Stock splits can impact the stock market by increasing liquidity, attracting new investors, and potentially influencing investor sentiment and demand. However, the overall market capitalization of the company remains unchanged.

Q6: Can a stock split affect a company's valuation?

While a stock split does not directly affect a company's valuation, it can influence investor perception and demand, potentially impacting the stock price and company valuation indirectly.

14. External Resources for Further Reading

For those interested in learning more about stock splits and their impact on the market, consider exploring resources such as the Securities and Exchange Commission (SEC) website or financial news outlets like Bloomberg and CNBC, which provide in-depth coverage and analysis of stock splits and related financial topics.

15. Conclusion

In conclusion, a 4 1 stock split is a strategic financial maneuver that companies use to adjust their stock prices and increase liquidity. While stock splits can signal a company's growth and confidence in its future performance, they do not inherently change the company's valuation or financial position. Investors should carefully consider the implications of a stock split, including its potential impact on investor sentiment, market perception, and overall investment strategy. By understanding the mechanics and motivations behind stock splits, investors can make informed decisions and capitalize on potential opportunities in the market.

Article Recommendations

- Kat Timpfs Husband Meet Husbands Name

- Top Megan Fox Pics Unforgettable Looks

- Sylvester Stallones 80s Iconic Action Rocky Returns