Boost Your Finances: Everything You Need To Know About Ascend Refinance Car Loan

So, you're thinking about refinancing your car loan with Ascend? Well, buckle up because we're about to take you on a deep dive into the world of car loan refinancing. Whether you're looking to lower your monthly payments, get a better interest rate, or just simplify your finances, Ascend Refinance Car Loan could be your golden ticket. This is where the magic happens, and we’re here to break it all down for you.

Now, let’s face it—money talk can get a bit overwhelming. But don’t worry, we’re here to make sure it’s as smooth as a Sunday drive. Refinancing a car loan isn’t rocket science, but it does require a bit of understanding. And hey, who doesn’t want to save some cash while still keeping their ride running smoothly?

In this guide, we'll explore everything you need to know about Ascend Refinance Car Loan, including how it works, what benefits it offers, and whether it’s the right move for you. Let’s get started, shall we?

Read also:Hugging Bub The Ultimate Guide To Understanding And Embracing This Heartwarming Trend

Here’s a quick rundown of what we’ll cover:

- What is Ascend Refinance Car Loan?

- Benefits of Refinancing Your Car Loan

- How Ascend Refinance Works

- Eligibility Criteria for Ascend Refinance

- Steps to Refinance Your Car Loan

- Costs and Fees Involved

- Tips for a Successful Refinance

- Common Questions About Ascend Refinance

- Alternatives to Ascend Refinance

- Final Thoughts

What is Ascend Refinance Car Loan?

Alright, let’s start with the basics. Ascend Refinance Car Loan is a financial service designed to help you renegotiate the terms of your existing car loan. Think of it as giving your car loan a makeover. You can adjust the interest rate, extend the loan term, or even reduce your monthly payments. It’s all about tailoring the loan to fit your current financial situation.

Ascend stands out because they offer competitive rates and a hassle-free process. They work with a variety of lenders, which means they can often secure better terms than your original loan provider. Plus, their customer service is top-notch, so you won’t feel like you’re navigating this alone.

Why Choose Ascend?

- Competitive interest rates

- Flexible loan terms

- Easy application process

- Excellent customer support

So, if you’re looking for a straightforward way to improve your car loan terms, Ascend could be just what the finance doctor ordered.

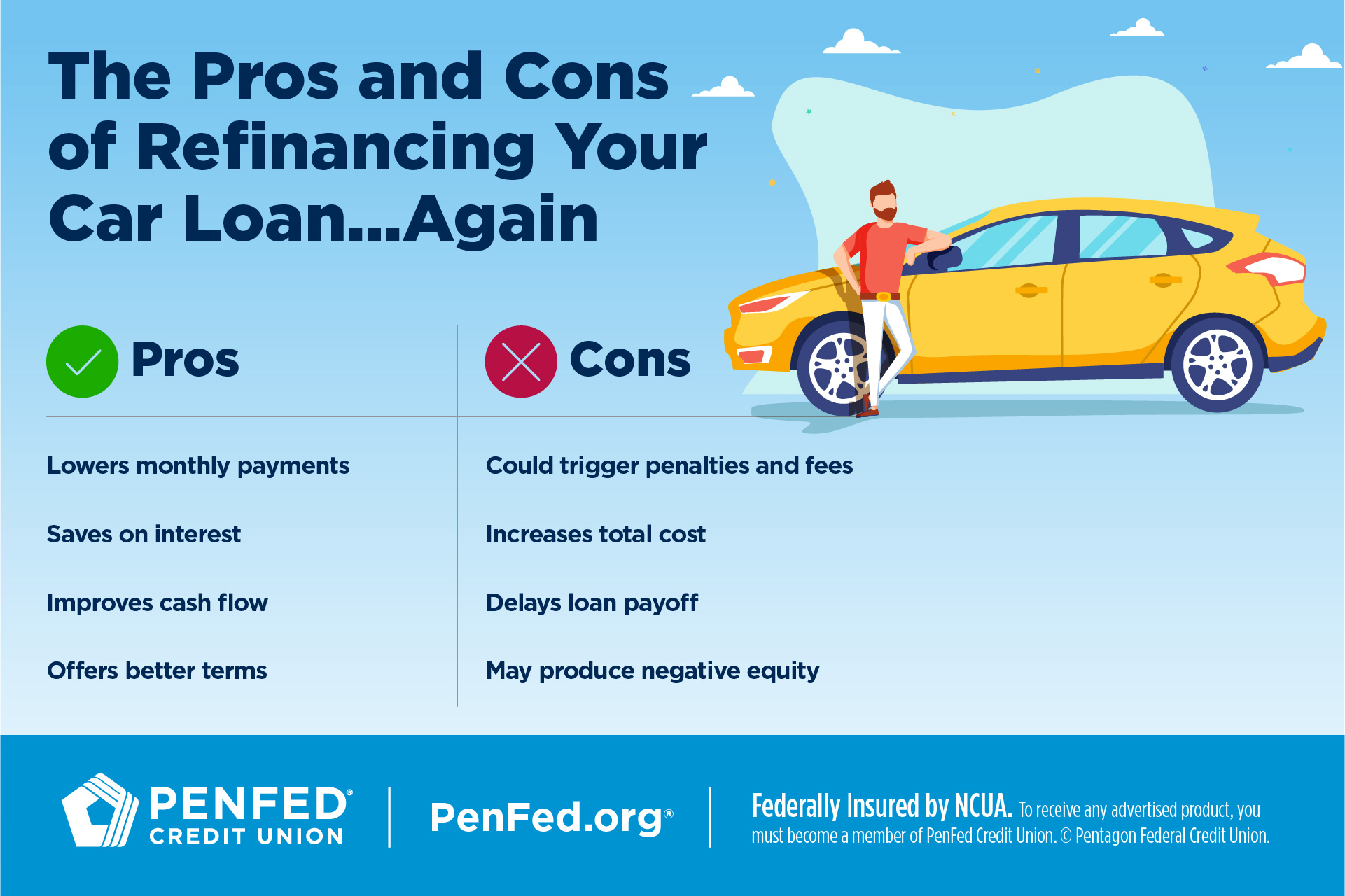

Benefits of Refinancing Your Car Loan

Let’s talk about the perks. Refinancing your car loan with Ascend can bring a whole bunch of benefits to the table. Here are some of the top reasons why people choose to refinance:

Lower Interest Rates

One of the biggest advantages is securing a lower interest rate. If your credit score has improved since you first took out the loan, you might qualify for a much better rate. Lower interest means more money in your pocket each month.

Read also:Prince Market Athens The Royal Experience Of Greek Shopping

Reduced Monthly Payments

Another great benefit is the potential to lower your monthly payments. By extending the loan term or securing a better rate, you can make your car payments more manageable. This can be a lifesaver if you’re dealing with a tight budget.

Improved Loan Terms

Refinancing gives you the opportunity to renegotiate the terms of your loan. Maybe you want to pay off your car faster, or maybe you need to extend the term to ease the financial burden. Ascend offers the flexibility to make these changes.

How Ascend Refinance Works

Now that we’ve covered the basics, let’s dive into how Ascend Refinance actually works. The process is pretty straightforward, and here’s a quick breakdown:

Step 1: Apply Online

It all starts with an application. You can apply online through Ascend’s website, and the process usually takes just a few minutes. You’ll need to provide some basic information about your current loan and your financial situation.

Step 2: Get Pre-Approved

Once you submit your application, Ascend will review your information and determine if you qualify for refinancing. If you’re pre-approved, you’ll receive a personalized offer with new loan terms.

Step 3: Finalize the Loan

If you’re happy with the offer, the next step is to finalize the loan. Ascend will pay off your existing car loan, and you’ll start making payments under the new terms. It’s as simple as that.

Eligibility Criteria for Ascend Refinance

Before you jump into the application process, it’s important to know if you’re eligible for Ascend Refinance. Here are some of the key criteria:

- Have a stable income

- Good credit score (usually above 650)

- Current car loan with at least 12 months remaining

- Vehicle must be less than 10 years old

While these are the general requirements, Ascend does consider individual circumstances, so it’s always worth applying to see if you qualify.

Steps to Refinance Your Car Loan

Ready to take the plunge? Here’s a step-by-step guide to refinancing your car loan with Ascend:

Step 1: Gather Your Documents

You’ll need to gather some documents to support your application, including proof of income, your current loan agreement, and vehicle details.

Step 2: Compare Offers

Once you’ve applied, Ascend will provide you with a few different loan options. Take the time to compare these offers and choose the one that best suits your needs.

Step 3: Sign the New Loan Agreement

After selecting your new loan terms, it’s time to sign the agreement. Ascend will handle the rest, including paying off your existing loan.

Costs and Fees Involved

Refinancing isn’t always free, so it’s important to understand the costs involved. Here are some of the fees you might encounter:

Origination Fees

Some lenders charge an origination fee for setting up the new loan. Ascend’s fees are usually pretty reasonable, but it’s always a good idea to ask upfront.

Prepayment Penalties

If your current lender charges a prepayment penalty for paying off the loan early, you’ll need to factor that into your decision. Ascend can help you navigate this.

Tips for a Successful Refinance

Refinancing your car loan can be a great move, but there are a few tips to keep in mind to make the process smoother:

- Shop around for the best rates

- Check your credit score before applying

- Read the fine print carefully

- Make sure the new terms are better than your current ones

By following these tips, you’ll increase your chances of a successful refinance and avoid any unpleasant surprises down the road.

Common Questions About Ascend Refinance

Let’s address some of the most common questions people have about Ascend Refinance:

Can I refinance if I have bad credit?

It’s possible, but it might be more challenging. Ascend typically looks for borrowers with good credit scores, but they do consider individual circumstances.

How long does the process take?

From application to approval, the process usually takes about a week. Once approved, the new loan can be set up within a few days.

Will refinancing affect my credit score?

Refinancing might cause a slight dip in your credit score due to the hard inquiry, but if you make your payments on time, it should recover quickly.

Alternatives to Ascend Refinance

While Ascend is a great option, there are other lenders out there offering similar services. Here are a few alternatives to consider:

LightStream

LightStream offers competitive rates and a user-friendly application process. They’re worth checking out if you’re looking for alternatives.

Ally Bank

Ally Bank is another popular choice for car loan refinancing. They offer flexible terms and excellent customer service.

Final Thoughts

So, there you have it—a comprehensive guide to Ascend Refinance Car Loan. Whether you’re looking to lower your interest rate, reduce your monthly payments, or improve your loan terms, Ascend could be the perfect solution. Just remember to do your research, compare offers, and make sure the new terms are better than your current ones.

If you’ve found this guide helpful, we’d love to hear from you! Leave a comment below or share this article with your friends. And if you’re ready to take the next step, head over to Ascend’s website and start your application today. Happy refinancing!