Chief Compliance Officer: The Key Player In Corporate Integrity

Picture this: you're running a company, and everything seems to be going smoothly. Sales are up, profits are soaring, and your team is working like a well-oiled machine. But wait—what about the legal stuff? Are you sure your business is fully compliant with all the rules and regulations? Enter the chief compliance officer (CCO), the unsung hero of corporate governance. This role isn’t just about ticking boxes; it’s about safeguarding your company’s reputation, ensuring ethical practices, and keeping you out of legal hot water.

The role of a chief compliance officer has become increasingly vital in today’s complex business environment. With regulations constantly evolving and penalties for non-compliance getting steeper, having a CCO is no longer optional—it’s essential. These professionals are the backbone of any organization, ensuring that every decision aligns with legal requirements and ethical standards.

In this article, we’ll dive deep into the world of chief compliance officers, exploring their responsibilities, the skills they need, and why they’re so crucial in maintaining a company’s integrity. So, whether you’re a business owner looking to hire a CCO or someone interested in pursuing this career path, buckle up—we’re about to break it all down for you!

Read also:Insta Cake The Ultimate Guide To Creating Viral Desserts

Who Exactly Is a Chief Compliance Officer?

Before we dive into the nitty-gritty, let’s first define who a chief compliance officer is. Simply put, a CCO is the person responsible for ensuring that an organization adheres to regulatory guidelines and internal policies. They’re like the company’s legal guardian, keeping everyone in check and making sure no one steps out of line.

Now, you might be thinking, “Isn’t that what lawyers are for?” Well, not exactly. While lawyers focus on legal issues after they arise, CCOs are more proactive. They anticipate potential problems, implement preventive measures, and ensure that the company remains compliant at all times. Think of them as the firefighters who prevent fires from happening in the first place.

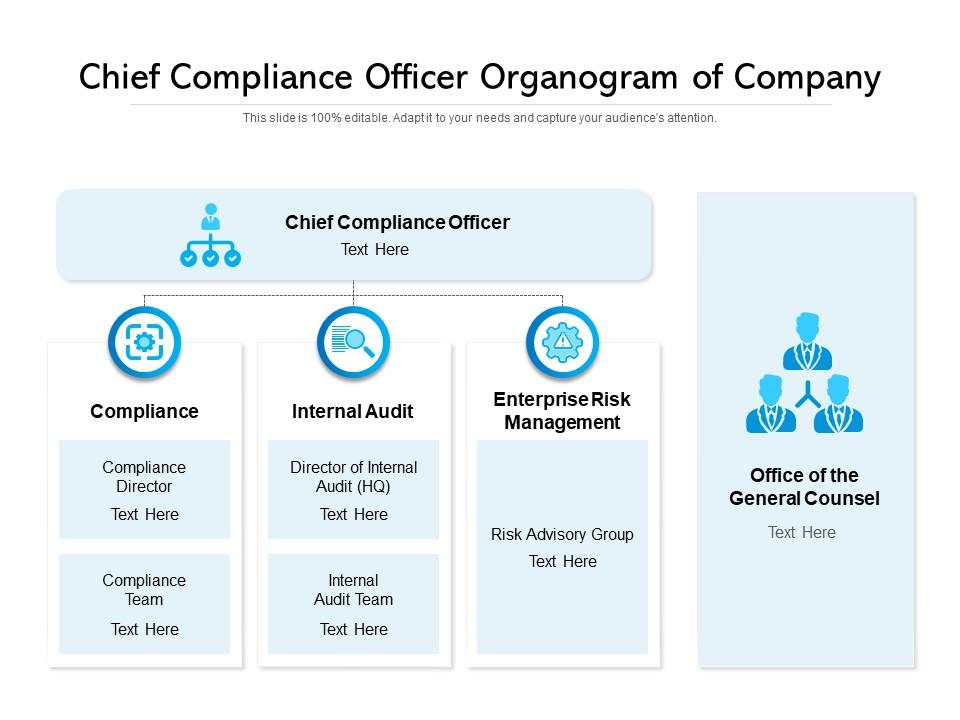

The Role of a Chief Compliance Officer in Today’s Business World

In today’s fast-paced business environment, the role of a CCO has expanded beyond just legal compliance. They’re now expected to manage risks, oversee ethical conduct, and even contribute to strategic decision-making. Here’s a quick rundown of what a CCO typically does:

- Monitors and enforces compliance with laws, regulations, and internal policies.

- Develops and implements compliance programs tailored to the organization’s needs.

- Conducts regular audits and risk assessments to identify potential issues.

- Provides training and education to employees on compliance matters.

- Collaborates with other departments to ensure alignment with compliance goals.

As you can see, the CCO’s responsibilities go far beyond just ticking off compliance boxes. They’re integral to the overall success and sustainability of a business.

Why Is a Chief Compliance Officer Important?

Let’s face it—non-compliance can be a nightmare for any organization. From hefty fines to reputational damage, the consequences of ignoring compliance can be devastating. This is where the CCO comes in. By ensuring that the company adheres to all relevant laws and regulations, they help mitigate these risks and protect the organization’s bottom line.

Moreover, a CCO plays a crucial role in fostering a culture of integrity within the company. They set the tone for ethical behavior, encouraging transparency and accountability at all levels. In an age where consumers and investors are increasingly demanding ethical practices, having a strong compliance program can give your business a competitive edge.

Read also:The Marathon Store Melrose Your Ultimate Athletic Haven

Skills Every Chief Compliance Officer Should Have

Being a CCO isn’t easy—it requires a unique blend of skills and expertise. Here are some of the key skills that every CCO should possess:

- Legal Knowledge: A solid understanding of laws and regulations relevant to the industry is a must.

- Risk Management: CCOs need to be able to identify potential risks and develop strategies to mitigate them.

- Communication Skills: Whether it’s explaining complex regulations to employees or presenting findings to senior management, effective communication is crucial.

- Leadership: CCOs often lead teams of compliance professionals, so strong leadership skills are essential.

- Problem-Solving: The ability to think critically and find solutions to complex compliance issues is vital.

Having these skills ensures that a CCO can effectively navigate the challenges of their role and drive compliance within the organization.

How to Become a Chief Compliance Officer

So, you’re interested in becoming a CCO? Great choice! But how do you get there? Here’s a roadmap to help you on your journey:

Education and Certifications

Most CCOs have a degree in law, business, or a related field. Additionally, obtaining certifications such as the Certified Compliance & Ethics Professional (CCEP) can significantly boost your credentials. These certifications demonstrate your commitment to the field and provide valuable knowledge and skills.

Experience

Experience is key in this role. Many CCOs start their careers in legal or regulatory roles, gradually working their way up to leadership positions. Gaining experience in different industries can also be beneficial, as it broadens your understanding of various compliance challenges.

Networking

Building a strong professional network is crucial in any career, and compliance is no exception. Attend industry events, join professional organizations, and connect with other compliance professionals to stay updated on the latest trends and best practices.

Challenges Faced by Chief Compliance Officers

While being a CCO can be rewarding, it’s not without its challenges. Here are some of the common obstacles that CCOs face:

- Keeping Up with Changing Regulations: Laws and regulations are constantly evolving, and CCOs must stay on top of these changes to ensure compliance.

- Resistance to Change: Implementing new compliance policies can sometimes meet resistance from employees or management, making it difficult to enforce.

- Resource Constraints: Budget and staffing limitations can hinder a CCO’s ability to implement comprehensive compliance programs.

Despite these challenges, a skilled CCO can navigate them successfully by staying informed, communicating effectively, and leveraging available resources.

The Future of Chief Compliance Officers

As technology continues to advance, the role of the CCO is also evolving. Automation and artificial intelligence are increasingly being used to streamline compliance processes, allowing CCOs to focus on more strategic tasks. However, the human element will always remain crucial—technology can’t replace the judgment and expertise that a CCO brings to the table.

Looking ahead, the demand for CCOs is expected to grow as organizations recognize the importance of compliance in today’s regulatory landscape. This presents exciting opportunities for those in the field, as well as for aspiring CCOs looking to make their mark.

Real-Life Examples of Chief Compliance Officers in Action

To give you a better idea of what CCOs do, let’s look at a couple of real-life examples:

Example 1: A Banking Scandal

In 2016, a major bank was fined billions of dollars for misleading customers about its products. The scandal led to a complete overhaul of the bank’s compliance program, with the CCO playing a pivotal role in implementing new policies and procedures to prevent similar issues in the future.

Example 2: A Pharmaceutical Company

A pharmaceutical company faced allegations of off-label marketing, resulting in significant fines. The CCO led the investigation, identified the root cause of the problem, and implemented corrective measures to ensure compliance moving forward.

These examples highlight the critical role that CCOs play in protecting organizations from legal and reputational risks.

How to Evaluate a Chief Compliance Officer’s Performance

Measuring the effectiveness of a CCO can be challenging, but there are several key indicators to consider:

- Compliance Incidents: A decrease in compliance-related incidents is a good sign that the CCO is doing their job well.

- Employee Engagement: High levels of employee participation in compliance training and awareness programs indicate a strong compliance culture.

- Regulatory Feedback: Positive feedback from regulatory bodies during audits or inspections is a testament to the CCO’s effectiveness.

By tracking these metrics, organizations can gain insight into the impact of their compliance programs and make necessary adjustments.

Conclusion: Why Every Business Needs a Chief Compliance Officer

In conclusion, the role of a chief compliance officer is more important than ever in today’s business landscape. From ensuring legal compliance to fostering a culture of integrity, CCOs play a vital role in safeguarding an organization’s future. Whether you’re a business owner or an aspiring CCO, understanding the importance of this role can help you make informed decisions that benefit your organization.

So, what are you waiting for? If you’re looking to enhance your company’s compliance efforts or pursue a career in compliance, now is the perfect time to take action. Share this article with your network, leave a comment below, and let’s keep the conversation going!

Table of Contents:

- Who Exactly Is a Chief Compliance Officer?

- The Role of a Chief Compliance Officer in Today’s Business World

- Why Is a Chief Compliance Officer Important?

- Skills Every Chief Compliance Officer Should Have

- How to Become a Chief Compliance Officer

- Challenges Faced by Chief Compliance Officers

- The Future of Chief Compliance Officers

- Real-Life Examples of Chief Compliance Officers in Action

- How to Evaluate a Chief Compliance Officer’s Performance

- Conclusion: Why Every Business Needs a Chief Compliance Officer